This type of formulas make a difference inventory cost and you may industry volatility, undertaking ripples one to eventually touch our very own profiles. Volume-weighted average rates strategy getaways right up an enormous buy and you will launches dynamically computed quicker pieces of your own purchase to your field using stock-particular historical frequency users. The aim is to perform your order near the volume-adjusted average rate (VWAP). Mean reversion method is in line with the build that higher and you will low prices away from an asset is a temporary trend one return on the imply worth (average well worth) sometimes. Determining and you will determining a cost variety and you will using an algorithm dependent in it allows positions to be placed immediately if the rate away from a secured asset holiday breaks inside and outside of the outlined variety. The opportunity of overtrading is additionally shorter that have computers trade—otherwise below-trade, in which traders gets disappointed easily in the event the a specific strategy doesn’t produce results straight away.

Servers can also be become familiar with industry research, choose trade options, and you will execute deals quicker than just individuals. It enables algorithmic traders to mine much more change potential than just guide traders is also and influence chances to possess a better monetary get back. Algorithmic exchange is the process of using software applications in order to automatically do positions based on predetermined groups of guidelines. Your put the brand new recommendations, including price levels, timing, technical indications, and other industry variables, and the program performs deals when those standards try came across. There are various type of trade options, plus the info will likely be endless, specifically that have AI technologies.

Important Equipment to possess Algorithmic Trading

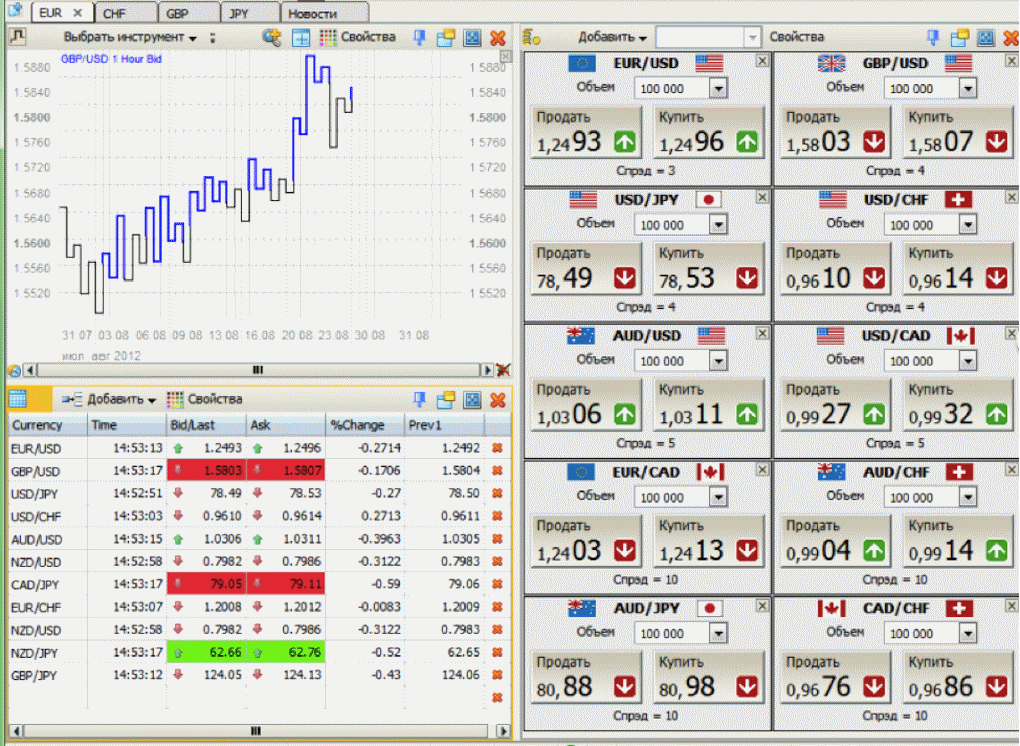

For every algorithm type of caters to particular change expectations which have line of mathematical designs deciding entry points, condition measurements, and exposure variables. The option immedchain.com relies on market conditions, funding needs, and scientific possibilities. Market-making formulas offer liquidity by the constantly setting buy and sell requests for an asset. These tips make the most of the newest bid-inquire pass on and therefore are widely used because of the institutional traders. Whether or not automatic or tips guide, attracting devices applies so you can maps, enabling image tips.

Benefits of Algorithmic trade so you can retail people

Information printed to your IBKR University that is available with third-people does not make-up a referral that you need to offer for the services of you to 3rd party. Accessibility each day AI-pushed quite happy with highlights from our industry-top look, records and you will field investigation to make a lot more informed decisions. Most advanced backtesting systems feature an enthusiastic optimizer which allows your to find the best factor options for the method. But not, when you have solid robustness assessment tips, the main reason that your actions falter won’t be so it, however, changes in the market. Places change throughout the day, just in case those alter affect some choices that the strategy try based on, one to means will get just are amiss.

Do you Make money On the Algorithmic Trading?

That it is the rapid and you will unstable changes in business costs and also the capability to execute deals rapidly and you may, moreover, at the need rates. Many other coding languages, such as Python or R, can be used to produce mathematical formulas you to play deals founded for the predetermined regulations. From the as well exchange in various property, buyers is also give the danger and relieve experience of people single trading otherwise field. AI-powered algorithmic trade and you may investment research change just how locations is actually managed, risks analyzed, and you may potential bare. Smarter, transformative, and quicker platforms are reshaping the continuing future of monetary locations, that have each other unmatched potential and you will the fresh layers out of chance and responsibility (1, 2, step 3, 4, 5).

However, any buyers was responsible for provided including guidance cautiously and you will researching how it you will relate with you to definitely reader’s individual choice to purchase, offer otherwise keep any money. Considering the computational concentration of powering formulas, of several buyers opt for cloud-founded measuring options. These types of support quicker investigation processing and you can persisted performance as opposed to counting on the local equipment. Albert Partner, an algo trader based in Montreal, Canada, have apparently generated production averaging 23% a-year since the 2000. You could go after with his investments, you can also learn his actions on your own. One of the reasons we love their service is the fact he teaches the laws on the algos the guy spends.

Key what you should understand algorithmic change

For example applying scalable and higher-results host, starting connections to related exchanges otherwise exchangeability organization, and you can partnering study feeds the real deal-go out market position. I encourage renting place on the a secluded machine which you can availableness out of your computer otherwise any kind of device make use of. This type of statistical patterns offer the capacity to parse huge volumes of study rapidly. Not only is the research and you will subsequent trade smaller, but it’s and less likely to produce error and mental bias. The working platform stands apart for its numerous customizable applications making it possible for cutting-edge buyers which have programming feel to create her trading apps.

Traders may great-tune their algorithms and improve her or him according to the backtesting results to switch results. Development and maintaining change algorithms requires tech experience with each other coding and you can economic locations. AI is sooner or later changing algorithmic exchange and you will financing research. Because of the 2025, the newest combination out of state-of-the-art AI patterns, machine discovering, and you will cloud systems is actually and then make trading reduced, more transformative, and you can significantly analysis-determined both for institutional and you will merchandising people (step 1, dos, 3).

Most of the time the new languages try get across-appropriate, and you will have the ability to transfer code from a single platform to the other instead of things. However, to your regarding mini futures, the field of futures trade has become setting up to the large people with less overall to help you trade! We’re following this very carefully and you may want to in the near future apply they inside our exchange path. What you would see would be the fact your earnings are seldom going becoming evenly marketed while in the day.

You’ll must carefully consider your financing requirements technological potential and you can exposure threshold ahead of using any exchange formula. Undertaking a trading formula requires a variety of coding possibilities and you will financial education. The method concerns mastering particular tech feel and you can using strict research steps to develop a professional automated trade program. Exchange formulas face certain demands that will impact the efficiency and you will precision. Information such limits support people implement compatible risk government steps and you may care for practical standards.

Algorithmic trading, labeled as algo trade or automatic change, means having fun with computer programs to perform exchange steps. It can make a log file named exchange.journal and you may facts purchase and sell actions as well as the timestamp and you will rate where those things are present. It will help remain an in depth list of all the trades performed by the the new algorithm, which makes it easier to research overall performance and recognize any conditions that get occur. While the formula is securely checked, it can be associated with a trading program or replace so you can play positions. The brand new formula constantly monitors the market industry, and if it means a swap possibility that suits its standards, it immediately urban centers the newest trade.